His Majesty’s Government has finally introduced the new salary requirements for a Skilled Worker Visa. From April 4th, 2024, if any business wants to sponsor non-UK nationals on a Skilled Worker Visa, they have to meet the new salary threshold, which is a minimum of £38,700 in a year.

Detailed Overview of the New Skilled Worker Visa Salary Requirements

Under new rules, employers must need to offer the standard salary for the type of work the employee will do, whichever is higher

- £38,700 Per Year

- The ‘going rate’ for the type of work the employee will do

It should be noted that if the going rate is higher than £38,700 per year, for instance, the IT Manager’s going rate is £50,900 per year, an employer must pay the amount to avoid visa rejection.

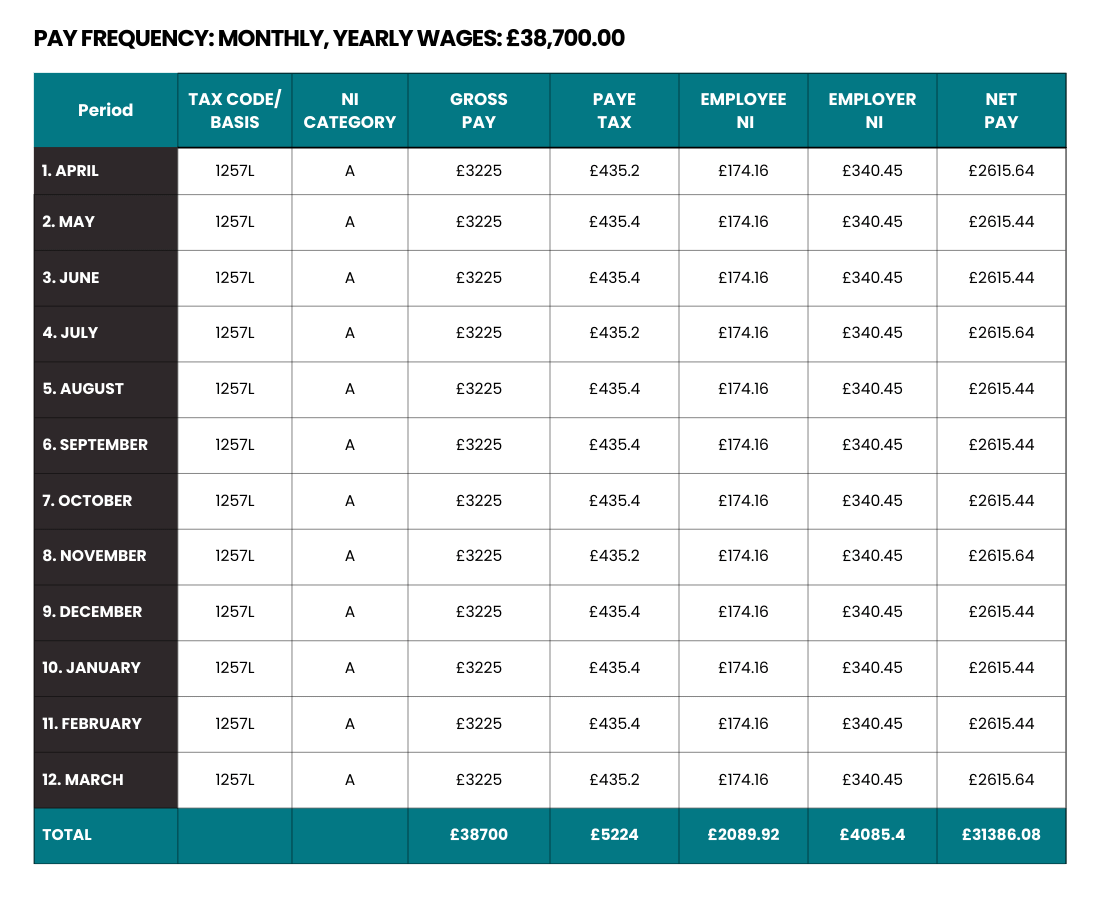

Monthly NI and Tax Implications for the £38,700 Salary Threshold

Let’s have a look at the monthly National Insurance (NI) and Tax that will be incurred for a salary of £38,700 per year. Here are the calculations:

As per £38,700 salary requirements, gross monthly will be £3,225. Monthly tax will be £435.20, and Employee NI will be £174.16 per month, which means £609.36 will be taken from employees’ pockets each month. On top of that, the business needs to pay Employer NI, which is £340.45 per month. However, if the company falls under the small business category, then up to £5,000 of Employer NI in a tax year is not required to pay, which is known as employment allowance.

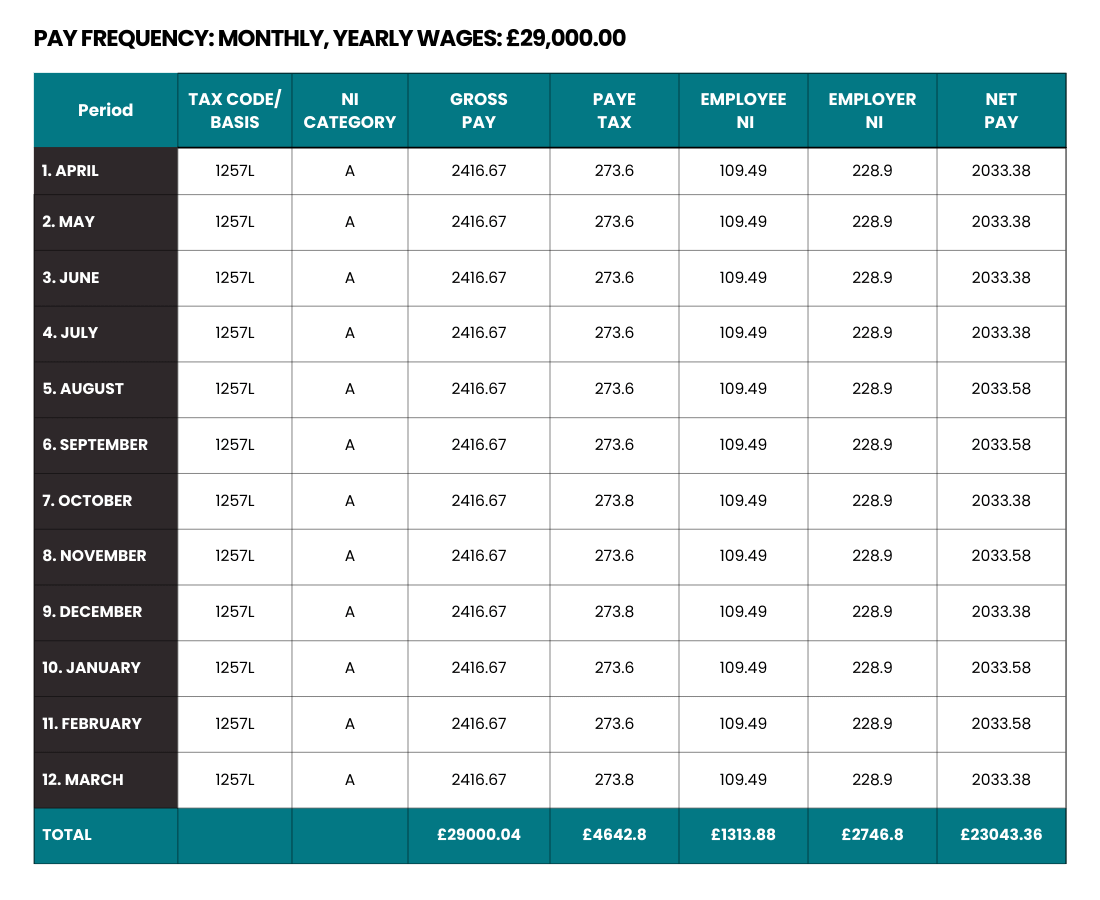

Comparative Salary Thresholds for Health and Care Worker Visas

However, this salary requirement does not apply to the health and care worker visa. Care workers need to be paid at least £29,000 per year. Below is a table of their monthly NI and tax costs.

Get Sponsor Licence

For Your Business

− No win no fee

− Guided by partnering lawyer

− 30-day free accounting service if needed

NI and Tax Implications for Care Workers

Under the new salary threshold, for the tax year 2024-25, care workers need to pay £273.6 of tax and £109.49 of NI each month, which is £383.09 in total. Again, the company that issued the work permit needs to pay another £228.9 of Employer NI on top of its total Employer NI crosses £5,000 in a year. This £5,000 allowance is only available for small businesses.

Need Assistance?

If you are planning to recruit a skilled worker and the salary requirement is different, we can help you calculate monthly NI and tax costs. Our partner lawyer can assist you in applying for a sponsorship license for your business under the No Licence, No Fee package. Call us on 07564 964141.

Frequently Asked Questions

What happens if my business doesn't meet the skilled worker visa salary limit?

If the CoS (Certificate of Sponsorship) does not meet the new salary requirement, the applicant’s visa application can be rejected or the matter can go to the caseworker.

How many hours can a Skilled Worker work in the UK?

Besides the sponsored job, skilled workers can work for an additional 20 hours a week in another job but work must be in an eligible occupation code.

What is the minimum salary for a new entrant skilled worker visa & COS?

The minimum salary for ‘new entrant’ skilled workers has to be not less than £30,960; and 70% of the prorated going rate for the occupation code, whichever is higher.

How many days can I stay outside the UK on a Skilled Worker visa?

You’re allowed a maximum of 180 days outside the UK within any 12 months. If any employee spends more time than this, it may impact their ILR (Indefinite leave to remain) application.

How much bank balance is required for a UK Skilled Worker visa?

To secure a UK Skilled Worker visa, you must show a bank balance of £1,270 for at least 28 days. Alternatively, if your employer provides financial support, they certify it on your application.

If my salary is £29,000 how much tax do I need to pay?

£273.6 Per month and NI will be £109.49 per month. Therefore, in total, it is £383.09. £29,000 minimum salary is applicable to care workers, senior care workers, etc.

If my salary is £38,700, how much tax do I need to pay?

£435.6 Per month and NI will be £174.16 per month. Therefore, in total, it is £609.36